The Dynamics of China's Private Cybersecurity Companies

Key Notes

State Influence: Chinese private cybersecurity firms operate under strong state influence, balancing innovation with political mandates.

State Image: China’s global ambitions face a trust deficit, as foreign skepticism limits their market access despite technical strength.

Influence & Expansion: China’s Indo-Pacific expansion challenges U.S. influence, shaping regional norms and requiring credible U.S. alternatives.

Background

China's ascent to the forefront of the global cybersecurity landscape has been closely intertwined with the rise of private entities such as Qihoo 360, Tencent Security, and QI-ANXIN Technology Group Inc [1]. This technological evolution is not confined to internal considerations within China; instead, it reverberates on the global stage, significantly influencing cybersecurity dynamics. Nowhere is this impact more pronounced than in the Indo-Pacific, a region that has assumed escalating significance for U.S. interests.

The relationship between Chinese private cybersecurity companies and the Chinese government is a multifaceted dynamic that significantly shapes the nation’s cybersecurity ecosystem. While these companies operate as private enterprises, they are far from independent actors in the broader landscape of national cybersecurity. The Chinese government plays a substantial role in guiding, regulating, and directly collaborating with these entities to achieve state cybersecurity objectives. This collaboration is not incidental but rather an intentional feature of China’s cyber governance model, rooted in the principle that cybersecurity is a matter of national security.

Collaboration typically takes the form of joint threat intelligence sharing, coordinated incident response efforts, and participation in state-led cybersecurity research initiatives. For example, Tencent Security has worked closely with the Ministry of Public Security in efforts to identify and neutralize malware campaigns and combat cybercrime, while Qihoo 360 has been instrumental in identifying advanced persistent threats (APTs) that align with national security concerns. These partnerships are further institutionalized through embedded Party committees and oversight structures such as the “Party Regulation Office,” which exist within major private firms and ensure alignment with national priorities.

Additionally, private firms are often called upon during national cybersecurity exercises and contribute to the development of technical standards and protocols that reflect state interests. The state, in turn, provides preferential treatment in public contracts and regulatory leeway to firms that demonstrate alignment with government goals. These cooperative mechanisms create a symbiotic relationship: the government benefits from the agility and innovation of the private sector, while companies gain political favor, market access, and regulatory protection.

This collaboration, however, also imposes constraints. Companies must carefully balance market-driven innovation with compliance to state mandates, navigating a regulatory environment where the boundary between public and private is deliberately blurred. As a result, the operational autonomy of these firms is often shaped by political considerations as much as by commercial logic.

In the context of the Indo-Pacific, where geopolitical tensions and security concerns are palpable, understanding the interplay between Chinese private cybersecurity firms and the government becomes imperative for the U.S. The Chinese government's regulatory framework and policy directives significantly impact the operations of these private entities. This influence extends to areas such as data privacy, information control, and the alignment of cybersecurity initiatives with broader national interests.

Qihoo 360, Tencent Security, and others, despite being private entities, maintain intricate relationships with Chinese regulatory bodies and security agencies. Collaborations with the Ministry of Public Security and other government agencies are not uncommon, illustrating the intertwining of private and state interests [2, 3]. These collaborations often serve dual purposes – bolstering the national cybersecurity posture and, concurrently, supporting the global expansion of Chinese cybersecurity firms.

The U.S.'s pursuit of a secure and cooperative cyber environment in the Indo-Pacific requires a nuanced understanding of these relationships. The evolving dynamics between Chinese private cybersecurity companies and the government have direct implications for regional cybersecurity stability. As the U.S. navigates its interests in the Indo-Pacific, it must consider not only the capabilities of these private entities but also the politically focused regulatory framework that guides their operations. The delicate balance between state control and private innovation in China’s cybersecurity domain is a key factor in shaping the broader geopolitical landscape in the Indo-Pacific, and the U.S. must adapt its strategies accordingly to foster a secure digital environment aligned with its interests.

Landscape of Chinese Private Cybersecurity Companies

The landscape of Chinese private cybersecurity companies reflects a vibrant and dynamic sector that dominates the cybersecurity domain in China. The cybersecurity sector in China is anticipated to achieve a market value of US$15.6 billion in 2023 and is projected to further grow to US$26.65 billion by 2027, reflecting a Compound Annual Growth Rate (CAGR) of 14.33%. It is estimated that China will contribute approximately 9% of the total revenue in the global cybersecurity market by the year 2023 [4].

According to recent industry reports, private companies, such as QI-ANXIN Technology Group Inc. and Beijing Chaitin Future Technology Co., Ltd, are the major companies that hold a significant majority share in the Chinese cybersecurity market, with an estimated market share of 50-60% [4]. The China Cybersecurity Market size is expected to grow from USD 15.58 billion in 2023 to USD 40.94 billion by 2028, at a CAGR of 21.31% during the forecast period (2023-2028). The government anticipates the industry to be valued at more than CNY 250 billion (USD 38.6 billion) by 2023 by encouraging the development of an increasing demand for goods and technologies, including data security monitoring and AI threat detection [5].

Nearly one-third of China's cybersecurity market is comprised of the public sector, and this trend is anticipated to persist. In 2021, government contracts constituted more than a quarter of the total cybersecurity business, experiencing a year-on-year growth of 2% [4]. This data underscores the prominence of private players in driving innovation and shaping the cybersecurity narrative within the country.

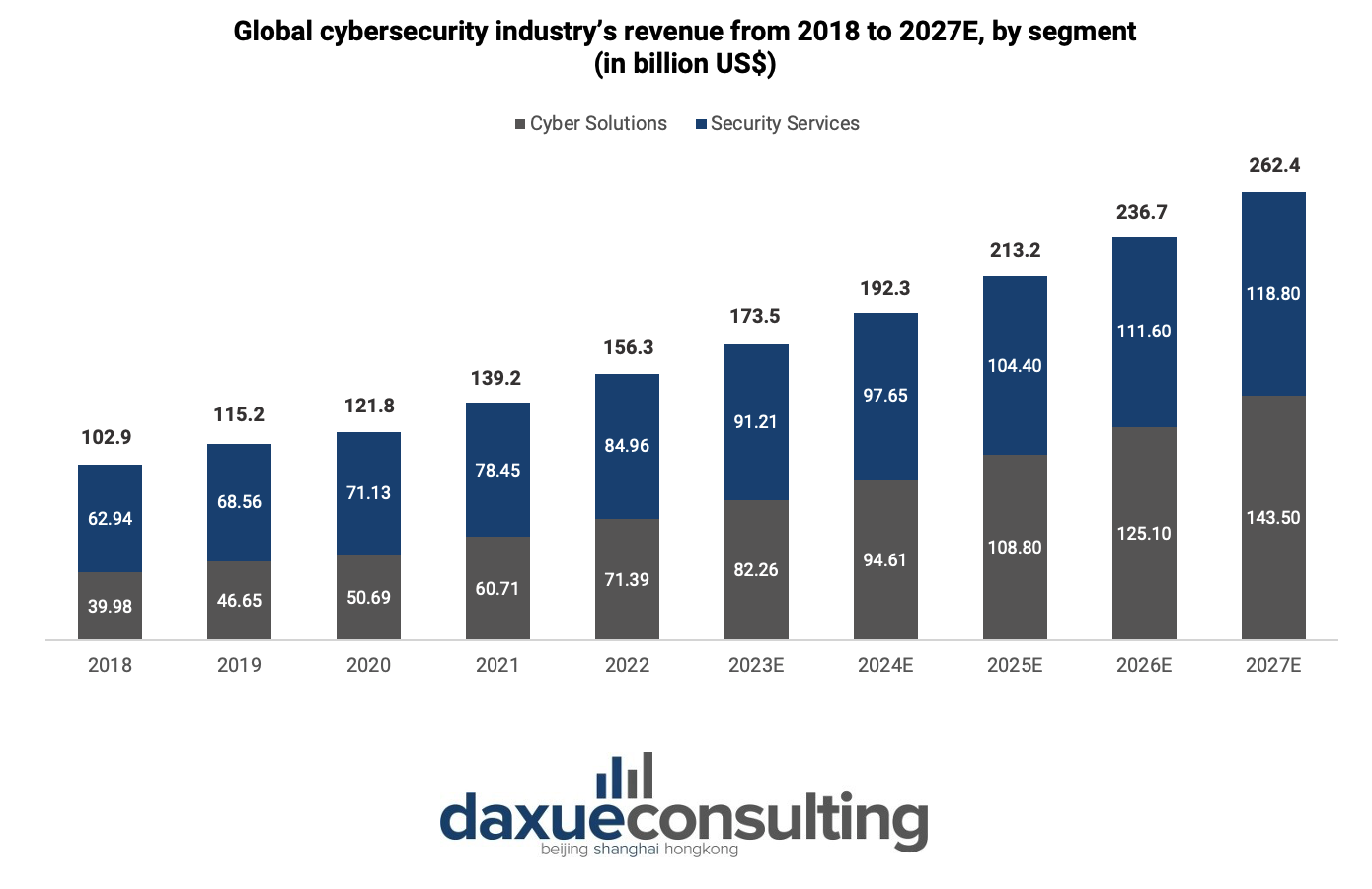

Fig.1 Graph source: Statista, designed by Daxue Consulting, China’s cybersecurity industry’s revenue from 2018 to 2027E, by segment [4]

Qihoo 360, a comprehensive cybersecurity provider, stands out as a major player in this landscape. Qihoo was the initial venture owner of QI-ANXIN Technology Group Inc. With over 500 million monthly active users, Qihoo 360's impact is widespread, offering a suite of services, including traditional threat detection, antivirus software, and vulnerability assessment [6]

Tencent Security, a subsidiary of Tencent Holdings, is another powerhouse, leveraging its parent company's extensive resources. Tencent holds a significant advantage as it was founded in 1998, making it the foremost internet and cybersecurity entity in China for more than three decades. Notably, Tencent Security has established a strong market presence, serving millions of clients globally and playing a pivotal role in safeguarding Tencent's extensive digital ecosystem. Tencent's influence is particularly pronounced in the public sphere, where it oversees the largest social media platform, WeChat [7].

A comparative analysis with state-owned entities like the China Information Technology Security Evaluation Center (CNITSEC) reveals the distinctive contributions of private players. While state-owned entities often prioritize government-centric initiatives and national security, private companies are more agile in responding to market demands and tend to focus on a broader array of cybersecurity services [8]. This diversification is evident in the services offered by Chinese private cyber companies, which showcase a range of services, from traditional cybersecurity measures to cutting-edge AI-driven solutions.

In summary, the landscape of Chinese private cybersecurity companies is marked by their dominance in market share, extensive user reach, and a diverse portfolio of services. These entities play a pivotal role in shaping the trajectory of cybersecurity in China, responding dynamically to market trends and technological advancements. As the private sector continues to drive innovation, it establishes itself as a key force in the ever-evolving landscape of cybersecurity within the country.

Contribution and the Vulnerabilities of Chinese Private Cybersecurity Companies

Chinese private cybersecurity companies are at the forefront of the industry, providing a spectrum of specialized services that contribute significantly to the cybersecurity landscape in China and beyond.

Qihoo 360, renowned for its comprehensive security services, offers a suite of solutions aimed at safeguarding users from a myriad of cyber threats. Among its key offerings is robust threat detection, employing advanced algorithms and real-time monitoring to identify and neutralize potential security risks. Qihoo 360's antivirus software is a cornerstone of its services, providing users with a robust defense against malware, viruses, and other malicious software. Additionally, the company excels in vulnerability assessments, proactively identifying weaknesses in systems and networks to fortify defenses against potential exploits. Qihoo 360's multifaceted approach underscores its commitment to providing holistic cybersecurity solutions [6].

Qihoo 360's involvement in handling significant cyber threats, such as the APT-C-00 campaign, underscores the practical impact of private companies in mitigating complex cyber risks. The Advanced Persistent Threat (APT) campaigns are sophisticated and often state-sponsored, posing serious challenges to national security [9]. Qihoo 360's proactive role in identifying, exposing, and responding to such threats demonstrates the agility and expertise that private cybersecurity firms bring to the table. This level of engagement complements government efforts, creating a robust cybersecurity ecosystem that can effectively counteract evolving and sophisticated cyber threats.

Tencent Security distinguishes itself through its strategic use of cutting-edge technologies. Leveraging advanced machine learning algorithms, Tencent Security enhances its cybersecurity capabilities to detect and respond to evolving threats effectively. The company's services extend to threat intelligence, employing sophisticated analytics to anticipate and mitigate emerging cyber risks. Tencent Security's emphasis on machine learning aligns with the industry's shift towards proactive and adaptive cybersecurity measures, showcasing its commitment to staying at the forefront of technological advancements [13].

Tencent Security exemplifies how private entities actively collaborate with government agencies to secure critical infrastructure. The Ministry of Public Security in China has recognized the strategic importance of leveraging private sector expertise, and Tencent Security has been at the forefront of such collaborations. These partnerships often involve information sharing, joint threat intelligence initiatives, and coordinated response efforts. By aligning their capabilities with the priorities of national cybersecurity, private companies contribute not only to their own success but also to the overall resilience of the country's digital infrastructure.

These companies' capabilities extend beyond national borders through strategic collaborations with international firms. For instance, Alibaba Cloud's partnership with Fortinet, facilitated by Tencent Security, exemplifies a collaborative effort to enhance cybersecurity infrastructure. Such partnerships bring together diverse expertise, combining Alibaba Cloud's robust cloud services with Fortinet's advanced cybersecurity solutions. This collaboration not only elevates the technological prowess of Tencent Security but also contributes to the global cybersecurity ecosystem.

From comprehensive threat detection and antivirus software to leveraging advanced technologies like machine learning and artificial intelligence, these companies play a pivotal role in addressing the complex and evolving cybersecurity challenges faced by individuals, enterprises, and organizations. Their collaborative efforts with international partners further amplify their capabilities, emphasizing their importance in the global cybersecurity landscape.

Challenges Faced by Chinese Private Cybersecurity Companies

Chinese private cybersecurity companies encounter a myriad of challenges as they navigate the intricate landscape of regulations, privacy concerns, and global competition. The regulatory environment in China is known for its complexity, with a set of stringent laws that private entities must adhere to, impacting various aspects of their operations.

Qihoo 360, despite its prominence, has faced scrutiny over privacy concerns. The regulatory landscape places significant emphasis on user data protection, and any perceived lapses can lead to investigations and public scrutiny. Qihoo 360's extensive user base makes it a focal point for privacy concerns. The company has had to invest substantially in compliance measures to align with regulatory expectations. This not only involves ensuring the secure handling of user data but also implementing transparency measures to address concerns related to data collection and usage. Navigating these privacy-related challenges is a constant endeavor for Chinese private cybersecurity firms.

Moreover, the intense competition within the domestic market adds another layer of complexity. The cybersecurity sector in China is highly competitive, with numerous private entities vying for market share. This competition fuels a race for innovation, with companies continually striving to outpace each other in developing cutting-edge technologies and services. This dynamic environment can be both a catalyst for growth and a source of pressure for private cybersecurity firms, pushing them to stay agile and responsive to market demands.

Global skepticism toward Chinese tech firms further complicates the international ambitions of private cybersecurity companies. This skepticism stems not only from individual company behavior but also from broader concerns about state influence, opaque corporate governance, and the Chinese Communist Party’s embedded role in private enterprises. The challenges faced by companies like Huawei, which has been banned or restricted from telecommunications infrastructure projects in countries like the U.S., U.K., and Australia, serve as a cautionary backdrop for firms such as Qihoo 360 and Tencent Security.

International markets remain wary of the potential for Chinese tech firms to act as conduits for state surveillance or influence operations. These concerns are amplified by China’s Cybersecurity Law, Data Security Law, and Intelligence Law, which legally obligate companies to cooperate with government intelligence work upon request—raising red flags about data privacy and foreign user protection. For example, Tencent, which operates globally through services like WeChat and Tencent Cloud, has been accused of surveilling international users to support domestic censorship objectives . Even in the absence of direct evidence of misconduct, the perception that Chinese private firms are subject to non-transparent government oversight often triggers preemptive regulatory responses abroad.

This scrutiny is particularly acute in sectors involving sensitive data, critical infrastructure, or national security. Western governments and cybersecurity alliances are increasingly placing Chinese firms under embargoes, restricting procurement, or launching investigations into partnerships and data flows. As a result, Chinese private cybersecurity companies face barriers to forming joint ventures, participating in multilateral cybersecurity forums, or gaining certifications and trustmarks in global markets.

In addition to regulatory hurdles, reputational risks have also impacted their global competitiveness. Partnerships with Western firms, such as Tencent's collaborations with global security vendors, are often subject to political pushback or terminated under public pressure. These dynamics contribute to a trust deficit that limits the international scalability of Chinese cybersecurity firms and reinforces geopolitical fragmentation in the global cyber landscape.

The challenges faced by these companies underscore the delicate balance they must strike between complying with domestic regulations, addressing privacy concerns, and overcoming global skepticism. They must demonstrate a commitment to transparency, data security, and international standards to navigate these challenges successfully. The experiences of Qihoo 360, Tencent Security, and other private cybersecurity firms in overcoming these hurdles provide insights into the evolving dynamics of the cybersecurity sector in China and its global implications.

Interactions with the Government

The interactions between private cybersecurity firms and the Chinese government are marked by a delicate balance between collaboration and autonomy. Examining Tencent Security's collaboration with the Ministry of Public Security provides a notable example of positive interactions between private cybersecurity firms and the government. The Ministry of Public Security, being a key government agency responsible for maintaining public order and security, recognizes the strategic importance of leveraging private sector expertise in the realm of cybersecurity [10]. Collaborative initiatives often involve joint efforts in threat intelligence sharing, cybersecurity research, and response coordination. Tencent Security, with its advanced technologies and comprehensive threat detection capabilities, becomes a valuable asset in the government's efforts to secure critical infrastructure and combat cyber threats.

However, maintaining autonomy within this collaborative framework presents challenges for private cybersecurity firms. While collaboration is essential for addressing complex and evolving cyber threats, private entities often operate with the need for agility, innovation, and flexibility. Navigating the regulatory landscape and complying with government directives without compromising the nimble nature of private firms can be intricate. Striking the right balance between contributing to national cybersecurity priorities and preserving operational independence is an ongoing challenge for companies like Tencent Security.\

Government support and policies significantly shape the operational landscape of private cybersecurity entities. Positive interactions often result from aligning the objectives of private firms with the broader national cybersecurity strategy. The Chinese government, recognizing the crucial role played by private companies, has implemented policies and initiatives to foster collaboration. However, the challenge lies in ensuring that these interactions do not lead to undue influence or compromise the innovative capacities of private entities. Moreover, the Chinese government showed its distrust in the private industry by enforcing the “Party Regulation Office“ in the companies.

The Chinese government has not entirely embraced the concept of providing unrestricted free-market support to companies. In other words, there is a reluctance or hesitancy on the part of the government, stemming from a concern about potentially relinquishing complete control over these companies. This caution is driven by the government's comprehensive understanding of the critical importance of cybersecurity, leading to a careful approach in balancing market dynamics with the imperative to maintain a level of control over these entities.

Involvement in International Cybersecurity Activities

Tencent Security's active involvement in international cybersecurity activities, exemplified by its global expansion and collaborations with INTERPOL, showcases a proactive approach that significantly contributes to shaping global cybersecurity norms and standards [11, 12]. This international engagement has direct implications for the broader Indo-Pacific region and aligns with U.S. interests in fostering a secure and cooperative cyber environment.

Tencent Security's global expansion is a strategic move that extends its reach far beyond China's borders. Tencent Security's commitment to fostering cross-border cooperation in combating cyber threats. This partnership involves sharing threat intelligence, coordinating response efforts, and collectively addressing cybercrime, reflecting a proactive and collaborative stance.

The evolving landscape of global cybersecurity, shaped by the activities of private companies, presents both challenges and opportunities for international collaboration. Challenges arise from the need to navigate diverse regulatory environments, cultural differences, and varying levels of technological maturity among participating nations. However, the opportunities lie in the potential for creating unified frameworks, establishing trust-based partnerships, and collectively addressing cyber threats that transcend geographical boundaries.

Motivations of Chinese Private Cybersecurity Firms

The motivations guiding Chinese private cybersecurity firms, such as Qihoo 360 and Tencent Security, encompass a multifaceted interplay of economic considerations and national security objectives. Analyzing these motivations is essential for comprehending the dynamics of the region's cybersecurity landscape and strategically engaging with the Indo-Pacific. This understanding is particularly crucial for the U.S. as it navigates potential areas of cooperation or competition that align with American interests.

The success of Chinese private cybersecurity firms in the global market is closely tied to the nation's economic prowess. As these companies expand internationally, their economic success contributes to China's technological and economic influence globally. Simultaneously, their alignment with national security objectives strengthens the country's overall cyber defenses and fosters a collaborative ecosystem where private entities actively support governmental cybersecurity priorities.

Economic considerations serve as a primary driver for Chinese private cybersecurity firms. The booming digital economy in China has created a lucrative market for cybersecurity services and solutions. Companies like Qihoo 360 capitalize on this economic opportunity by providing a comprehensive suite of cybersecurity services to a vast user base. The economic motivation is evident in Qihoo 360's successful initial public offering (IPO), showcasing how private firms seek financial success and market dominance. This economic drive fosters innovation, competition, and a continual push for technological advancements within the cybersecurity sector.

National security objectives also play a pivotal role in motivating Chinese private cybersecurity firms. In alignment with broader government objectives, firms like Tencent Security actively contribute to safeguarding critical national infrastructure from cyber threats. This motivation aligns with China's overarching goal of ensuring its cyber sovereignty and protecting against potential cyber espionage or attacks. By actively engaging in national security efforts, these private entities contribute to the country's overall cyber resilience and demonstrate a commitment to supporting governmental objectives.

Understanding these motivations is imperative for the U.S. to strategically engage with the Indo-Pacific region. Recognizing the intertwined nature of economic and national security interests allows for more nuanced diplomatic approaches. Areas of potential cooperation may include information sharing, joint research and development initiatives, and collaborative efforts to address shared cybersecurity challenges. However, potential areas of competition may arise concerning technological dominance, influence in regional cybersecurity standards, and the development of advanced cybersecurity capabilities.

Implications for Indo-Pacific and U.S. Cybersecurity Efforts

The activities of Chinese private cybersecurity firms extend well beyond China's borders, shaping the digital landscape of the Indo-Pacific and directly influencing U.S. cybersecurity interests. As firms like Qihoo 360 and Tencent Security expand their regional footprint, they help establish cybersecurity norms and technical standards that neighboring countries may adopt—often by default due to affordability, availability, or political alignment. This has significant implications for the resilience of digital infrastructure in the region and challenges U.S. efforts to promote a secure and interoperable cyber environment aligned with democratic values.

The growing adoption of Chinese cybersecurity technologies also positions China as a regional innovation hub, particularly in emerging fields like artificial intelligence and machine learning. This trend may erode U.S. technological leadership and limit the reach of U.S. cybersecurity frameworks. For American policymakers, safeguarding technological influence requires not only investing in innovation but also building trusted partnerships that offer credible alternatives to Chinese systems.

At the same time, the Indo-Pacific’s complex cybersecurity environment presents both opportunities and risks. Shared concerns about state-sponsored cyber threats and critical infrastructure vulnerabilities create natural avenues for cooperation between the U.S. and regional allies. However, competing visions of digital governance and uneven regulatory capacities require the U.S. to adopt a flexible, nuanced diplomatic strategy. Addressing these dynamics is essential for advancing a regional cybersecurity architecture that both mitigates threats and supports long-term U.S. strategic and economic interests.

Conclusion

Together, these factors underscore the enduring challenge for Chinese private cybersecurity firms: building global credibility while operating within a system where the boundaries between state and enterprise remain deliberately blurred. Chinese private cybersecurity firms like Qihoo 360 and Tencent Security wield significant influence, shaping cybersecurity norms and technological advancements in the Indo-Pacific region. Their success in the global digital economy, driven by economic considerations, is accompanied by a delicate balance with national security objectives, contributing to China's cyber resilience. The interactions with the Chinese government showcase a nuanced relationship, requiring a careful balance between collaboration and maintaining operational autonomy. Their proactive involvement in international cybersecurity activities aligns with U.S. interests, presenting both challenges and opportunities for cooperation in the evolving Indo-Pacific cybersecurity landscape. Policymakers must navigate these complexities to foster collaboration, safeguard national interests, and ensure a secure digital environment.

References

Morgan, Steve. “China Cybersecurity Companies.” Cyber Crime Magazine. September 21, 2020.

Sina News. “Taking Stock of Internet Companies That Have Established Party Committees: In Fact, Besides the BATs, There Are Many Others.” Sina News. July 1, 2017. https://finance.sina.cn/tech/2017-07-01/detail-ifyhrxtp6420838.d.html.

Xinhua News. “Tencent, Ofo, Zhihu... What Is the Significance Behind the 'Party Building Trend' in Internet Companies?” Xinhua News. March 30, 2018. http://www.xinhuanet.com/politics/2018-03/30/c_129841004.htm.

Daxue Consulting. “China’s Cybersecurity Industry: Growing Opportunities Due to Digitalization and Favorable Policies.” Daxue Consulting. January 26, 2023. https://daxueconsulting.com/chinas-cybersecurity-industry/.

Mordor Intelligence. “China Cybersecurity Market Size & Share Analysis – Growth Trends & Forecasts (2023–2028).” Mordor Intelligence. https://www.mordorintelligence.com/industry-reports/china-cybersecurity-market.

Qihoo 360. “Qihoo 360.” Accessed July 30, 2025. http://www.360.cn/about/englishversion.html.

Alon, Ilan, and Wenxian Zhang. Biographical Dictionary of New Entrepreneurs and Business Leaders. Cheltenham, UK: Edward Elgar, 2014. Accessed via Wayback Machine, June 26, 2014.

China Information Technology Security Evaluation Center. “China Information Technology Security Evaluation Center.” Accessed July 30, 2025. http://www.itsec.gov.cn/fz/en/201708/t20170802_15316.html.

Cybereason. Dahan, Assaf. “Operation Cobalt Kitty – Threat Actor Profile & Indicators of Compromise.” Cybereason. https://www.cybereason.com/hubfs/Cybereason%20Labs%20Analysis%20Operation%20Cobalt%20Kitty-Part3.pdf.

Ministry of Public Security. “Ministry of Public Security.” The State Council of the People’s Republic of China. Accessed July 30, 2025. https://english.www.gov.cn/state_council/2014/09/09/content_281474986284154.htm.

Kharpal, Arjun. “Chinese Tech Giant Tencent Reportedly Surveilled Foreign Users of WeChat to Help Censorship at Home.” CNBC. May 8, 2020.

Wen, Philip. “China's Xi Says Will Support Interpol Raising Its Profile.” Reuters. September 26, 2017.

“Tencent” https://www.tencent.com/en-us/index.html